Yield Hacking for Fun and Profit

Over the last two years, DeFi has seen an incredible amount of innovation. Many teams have rebuilt the core primitives necessary to create a new financial system from scratch — exchange, lending, derivatives, and so on. Each of these new protocols have created new ways for regular people to make money — lending out assets, providing liquidity to an automated market maker, or minting synthetic assets.

This has organically spawned a community of people focused on earning enhanced yields by combining these protocols together in interesting ways, a.k.a “yield hacking”. For example, people have figured out how to arbitrage interest rates on different lending protocols, recursively borrow-lend assets to farm token incentives, or provide liquidity on automated market makers on leverage.

In the short term, simple yield hacking strategies in DeFi still produce high returns — most of them revolve around passively providing liquidity to farm token incentives, then selling those tokens back for the original asset. But what happens when those token incentives run out? Yield hacking in its current form runs on unicorn bucks, not financial engineering, and will run out at some point. Over the long-term, yield hackers will need to level up and use more powerful tools like derivatives to drive returns or reduce risk.

In traditional finance, these strategies are typically constructed by teams of MIT-trained quants, who try to squeeze out yield by combining a bunch of financial derivatives together, like a fixed-income instrument plus an option. They are then repackaged and sold to high net worth individuals or hedge funds under a broad category called “structured products”. These come with their own set of problems — they are extremely opaque and the brokers may not be able to honor payouts (counterparty risk a la 2008), access is highly limited based on geography, and they often require large investment minimums to participate.

Building these structured products on DeFi offer a unique opportunity. Instead of having institutions construct these complicated payout structures, can smart contracts act as your broker? The contracts can source liquidity from various on-chain derivatives protocols, compose them together to achieve some specific risk objective, while staying 100% transparent at all times. Furthermore, anyone who has access to the Ethereum network can interact with these contracts permissionlessly. No need to go to a broker or investment bank.

Introducing Ribbon

Ribbon Finance is a new company focused on creating crypto structured products on DeFi. We are focused on building new financial products that can be created through cross-protocol composition, to help users achieve a superior risk-return profile than they would be able to on their own.

We are focused on products to tackle four broad categories of opportunities:

Volatility

- Products that let users long or short volatility of various cryptoassets for speculation or hedging purposes

Yield Enhancement

- Active and passive products that let users earn high yields (3-digit APY) by stacking yield-bearing instruments with writing options

Principal Protection

- Investment products that guarantee the user will get their money back, plus potential upside. These can be constructed through a combination of fixed-income products and options

Accumulation

- Products that let users accumulate their favourite assets over time, through strategies such as automated put option selling & reinvesting the yield into accumulating more assets

We envision that a large group of retail investors in crypto would want to deploy their capital in at least one of these buckets, to complement their existing positions or to generate yield on their long-term holdings. Our goal is not only to bring these financial instruments on-chain, but also to build a world-class product that surfaces the best financial products, and simplifies the experience of investing in them. We want to grow the market for retail-focused structured products to the entire world, and we’re starting here.

Live on Mainnet

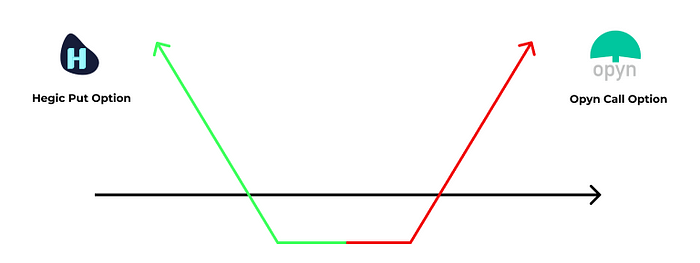

Today, we are launching Ribbon on mainnet, with the first product being a Strangle option, that lets users long ETH volatility. This product combines a put option and a call option at different strike prices, allowing investors to profit when the price of ETH goes above or beyond some thresholds.

To construct this Strangle, we source liquidity from the two foremost options protocols on Ethereum — Hegic and Opyn. Ribbon finds the cheapest prices on both venues for the put and call option, then purchases the options on the users’ behalf and packages them within a smart contract. This is the first multi-protocol option construction on Ethereum.

We are starting out with 3 versions of the ETH Strangle with different expiries, and you can buy them here today.

Looking Forward

Post launch, we are starting work on two big projects:

- Continual integrations with other on-chain options protocols to get better prices for our users and create more complex products. If you are working on one of these protocols, send us a DM on Twitter @ribbonfinance

- We are starting to work on our next product, a perpetual structured product to earn yield on ETH through selling options. This is still in the research phase, so join our community Discord to learn more or contribute ideas!

To build these things, we need your help! We are hiring fullstack engineers and solidity engineers who have a strong interest in finance to help us build Ribbon. Read our job descriptions here or reach out to us if you are interested in any of these roles.